Recently, a major news emerged from the semiconductor industry. Japanese CMP (Chemical Mechanical Polishing) slurry giant AGC (formerly Asahi Glass Co., Ltd.) has announced a supply halt. It has been reported that its Fab1 DSTI slurry (Material Number: M2701505, AGC-TW) has been suspended. This sudden development has drawn the attention of industry insiders.

Analysts point out that the direct cause of the supply disruption is Taiwan’s new export review policy on key semiconductor chemicals. The policy enforces stricter controls over the export of specific high-end materials. This affects several product models required for advanced manufacturing processes.

AGC has a production base in Taiwan, mainly supplying the Asian market. As a result, several downstream wafer fabs in mainland China are urgently assessing alternatives. Some have begun increasing procurement from other overseas suppliers and domestic brands. However, tight supply may persist in the short term.

CMP: The Ultra-Flat Stage for Wafers

With the advancement of integrated circuit technology—particularly in the sub-micron era—the reduction in feature size and the push for higher device density have made interlayer flatness increasingly critical. Consequently, the demand for ultra-precision surface treatment and high surface quality of semiconductor substrates continues to rise.

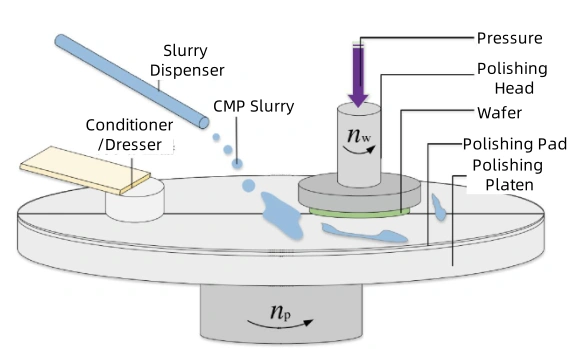

Currently, Chemical Mechanical Polishing (CMP) is the only key technology capable of achieving global planarization. As the minimum feature size of integrated circuit components shrinks to 7nm and even 5nm, CMP technology has rapidly advanced over recent decades. Its polishing precision now reaches the nanometer level and is widely adopted in semiconductor manufacturing.

CMP has become a standard process in nano-scale integrated circuit production, supporting the continued development of Moore’s Law. In semiconductor processing, CMP ensures a highly flat wafer surface, providing a solid foundation for subsequent steps such as lithography and etching. It is a vital process in advanced chip manufacturing.

Urgent Need for Breakthroughs in Slurry Key Materials

CMP removes material and achieves global surface flatness through a combination of chemical reactions between the polishing liquid and the target material. The mechanical action of abrasive particles within the slurry.

Therefore, the polishing liquid is one of the core consumables in the CMP process. Its performance directly affects polishing efficiency and chip surface quality.

Currently, the global CMP slurry market is highly concentrated, with American and Japanese manufacturers controlling over 80% of the market. Japanese companies dominate the high-end segment.

Although some Chinese companies have achieved substitutions in the low- and mid-end product ranges, the self-sufficiency rate for mid- to high-end products remains below 20%, highlighting the urgent need for domestic alternatives.

One major reason for the lack of self-sufficiency in mid- to high-end polishing liquids is the incomplete localization of key raw materials.

Take abrasives, for example: in CMP, the three most commonly used abrasives are Al₂O₃, SiO₂, and CeO₂. These provide the mechanical force needed to remove material from wafer surfaces and are essential raw materials for CMP slurry.

Summary

It has been reported that 14nm and below production lines at companies such as SMIC and Huahong Semiconductor consume more than 1,000 tons of polishing slurry per month. A supply cut may lead to production line shutdowns.

A leading wafer fab disclosed that polishing slurry inventory typically lasts only 1–2 months. If the supply disruption continues, Q3 production capacity could be reduced by 10%, making the situation highly urgent.

This incident serves as a warning: supply chain security is not limited to equipment and chips, but also includes critical consumables like polishing slurry and upstream materials such as high-purity alumina—both of which remain vulnerable bottlenecks.

China’s semiconductor materials sector must accelerate efforts to reduce external dependency. Otherwise, similar crises could recur, threatening the long-term development of the country’s semiconductor industry.

Epic Powder

As a trusted partner in materials processing, Epic Powder Machinery specializes in the production of high-performance grinding and classification equipment. With deep expertise in fine powder technology, we support the semiconductor and electronic materials industries by providing customized solutions for the preparation of key materials such as alumina, silica, and other high-purity powders.