2024 ਵਿੱਚ, ਕੈਥੋਡ ਮਟੀਰੀਅਲ ਮਾਰਕੀਟ ਨੇ ਸਪਲਾਈ-ਮੰਗ ਅਸੰਤੁਲਨ ਦਾ ਅਨੁਭਵ ਕੀਤਾ। ਪ੍ਰਮੁੱਖ ਵਾਹਨ ਨਿਰਮਾਤਾਵਾਂ ਵਿੱਚ ਕੀਮਤਾਂ ਦੀ ਲੜਾਈ ਕਾਰਨ ਟਰਨਰੀ ਲਿਥੀਅਮ ਬੈਟਰੀਆਂ ਦੀ ਵਰਤੋਂ ਵਿੱਚ ਗਿਰਾਵਟ ਆਈ, ਜਦੋਂ ਕਿ ਲਿਥੀਅਮ ਆਇਰਨ ਫਾਸਫੇਟ (LFP) ਮਟੀਰੀਅਲ ਦੀ ਮੰਗ ਵਿੱਚ ਵਾਧਾ ਹੋਇਆ। ਨਤੀਜੇ ਵਜੋਂ, LFP ਵੌਲਯੂਮ ਦਾ ਨਿਰਵਿਵਾਦ ਰਾਜਾ ਬਣ ਗਿਆ। ਬਾਜ਼ਾਰ ਦੇ ਰੁਝਾਨਾਂ - ਭਾਵੇਂ ਵਧ ਰਹੇ ਹੋਣ, ਡਿੱਗ ਰਹੇ ਹੋਣ, ਜਾਂ ਕਾਇਮ ਰਹਿਣ - ਨੇ ਕੁਝ ਕੰਪਨੀਆਂ ਨੂੰ ਇੱਕ ਦਹਾਕੇ ਦੇ ਸੰਭਾਵੀ ਨੁਕਸਾਨ ਲਈ ਤਿਆਰ ਰਹਿਣ ਲਈ ਪ੍ਰੇਰਿਤ ਕੀਤਾ ਹੈ। ਐਪਿਕ ਪਾਊਡਰਦੇ ਜੈੱਟ ਮਿੱਲ ਮਸ਼ੀਨਾਂ ਮਜ਼ਬੂਤ ਅਤੇ ਨਿਰੰਤਰ ਕਾਰਜ ਲਈ ਤਿਆਰ ਕੀਤੀਆਂ ਗਈਆਂ ਹਨ। ਸਾਡੀਆਂ ਜੈੱਟ ਮਿੱਲ ਮਸ਼ੀਨਾਂ ਕੈਥੋਡ ਸਮੱਗਰੀ ਨੂੰ 3-45 ਮਾਈਕਰੋਨ ਦੀ ਨਿਸ਼ਾਨਾ ਬਾਰੀਕੀ ਤੱਕ ਕੁਸ਼ਲਤਾ ਨਾਲ ਪੀਸ ਸਕਦੀਆਂ ਹਨ। ਇਹ ਉਤਪਾਦ ਉਦਯੋਗਿਕ ਸੀਲਾਂ, ਰਗੜ ਸਮੱਗਰੀ ਦੇ ਨਿਰਮਾਣ ਵਿੱਚ ਅਤੇ ਸੰਯੁਕਤ ਸਮੱਗਰੀ ਵਿੱਚ ਇੱਕ ਮਜ਼ਬੂਤੀ ਏਜੰਟ ਵਜੋਂ ਵਿਆਪਕ ਤੌਰ 'ਤੇ ਵਰਤਿਆ ਜਾਂਦਾ ਹੈ, ਇਸਦੀ ਉੱਤਮ ਸ਼ੁੱਧਤਾ ਅਤੇ ਰੂਪ ਵਿਗਿਆਨ ਦੇ ਕਾਰਨ।

ਸਾਲ 2024 ਉਦਯੋਗਿਕ ਅਪਗ੍ਰੇਡ ਅਤੇ ਖਾਤਮੇ ਦੇ ਇੱਕ ਨਵੇਂ ਦੌਰ ਦੀ ਸ਼ੁਰੂਆਤ ਸੀ। ਤਾਂ, 2025 ਵਿੱਚ ਬਾਜ਼ਾਰ ਕਿੱਥੇ ਜਾ ਰਿਹਾ ਹੈ?

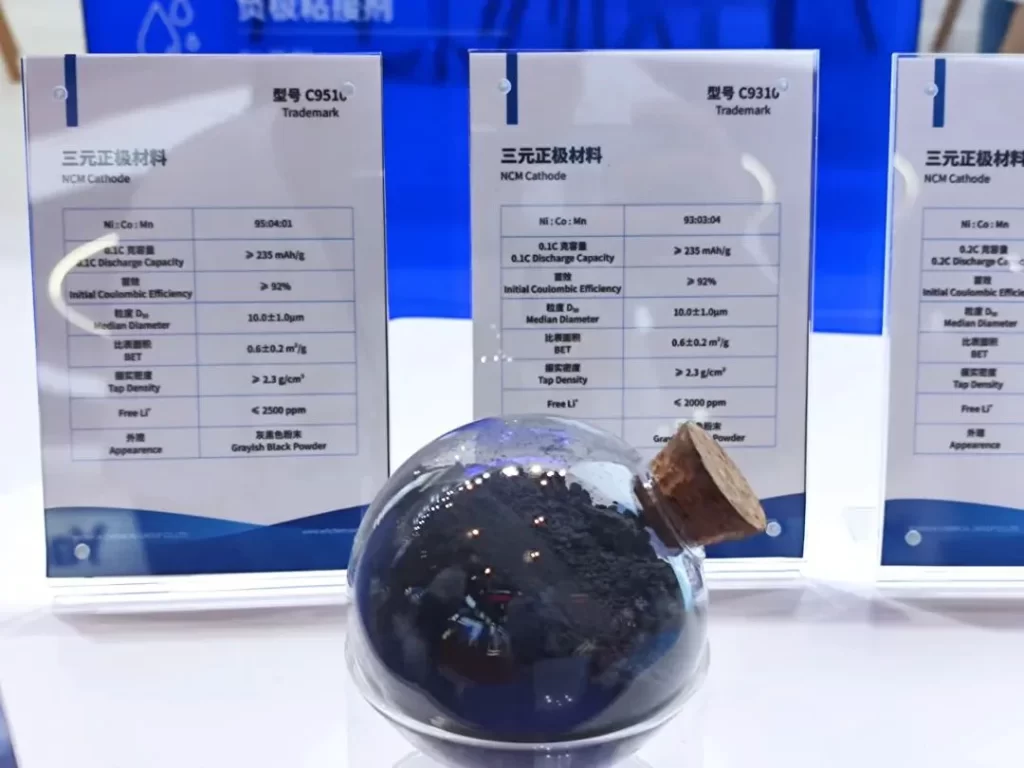

ਟਰਨਰੀ ਸਮੱਗਰੀ

2024 ਵਿੱਚ ਟਰਨਰੀ ਮਟੀਰੀਅਲ ਦਾ ਪ੍ਰਦਰਸ਼ਨ ਸ਼ੁਰੂ ਵਿੱਚ ਚਿੰਤਾਜਨਕ ਸੀ ਪਰ ਬਾਅਦ ਵਿੱਚ ਸਥਿਰ ਹੋ ਗਿਆ। ਸਾਲ ਦੇ ਪਹਿਲੇ ਅੱਧ ਵਿੱਚ, ਉਦਯੋਗ ਨੇ ਮੁਨਾਫ਼ੇ ਅਤੇ ਨੁਕਸਾਨ ਦਾ ਮਿਸ਼ਰਣ ਦੇਖਿਆ। ਹਾਲਾਂਕਿ, ਜਿਵੇਂ-ਜਿਵੇਂ ਦੂਜੀ ਅੱਧ ਵਿੱਚ ਕੀਮਤਾਂ ਠੀਕ ਹੋਈਆਂ, ਨੁਕਸਾਨ ਹੌਲੀ-ਹੌਲੀ ਬੰਦ ਹੋ ਗਿਆ, ਅਤੇ ਮੁਨਾਫ਼ਾ ਵਾਪਸ ਆਉਣਾ ਸ਼ੁਰੂ ਹੋ ਗਿਆ।

ਅੰਕੜੇ ਦਰਸਾਉਂਦੇ ਹਨ ਕਿ ਜਨਵਰੀ ਤੋਂ ਨਵੰਬਰ 2024 ਤੱਕ, ਲਿਥੀਅਮ ਬੈਟਰੀ ਸਮਰੱਥਾ 473 GWh ਤੱਕ ਪਹੁੰਚ ਗਈ, ਜੋ ਕਿ ਸਾਲ-ਦਰ-ਸਾਲ 39% ਵਾਧਾ ਹੈ। ਪ੍ਰਸਿੱਧੀ ਵਿੱਚ ਵਾਧਾ ਮੁੱਖ ਤੌਰ 'ਤੇ LFP ਦੁਆਰਾ ਚਲਾਇਆ ਗਿਆ ਸੀ, ਜਦੋਂ ਕਿ ਟਰਨਰੀ ਲਿਥੀਅਮ ਬੈਟਰੀਆਂ ਦੇ ਬਾਜ਼ਾਰ ਹਿੱਸੇ ਵਿੱਚ ਗਿਰਾਵਟ ਆਈ।

ਜਿਵੇਂ-ਜਿਵੇਂ ਮੰਗ ਵਿੱਚ ਵਾਧਾ ਹੌਲੀ ਹੋ ਗਿਆ, ਟਰਨਰੀ ਕੈਥੋਡ ਸਮੱਗਰੀ ਦੀਆਂ ਕੀਮਤਾਂ ਸਥਿਰ ਹੋ ਗਈਆਂ, ਹਾਲਾਂਕਿ ਦੂਜੇ ਅੱਧ ਵਿੱਚ ਸਥਿਰਤਾ ਦੇ ਸੰਕੇਤ ਸਾਹਮਣੇ ਆਏ। ਜਦੋਂ ਕਿ ਟਰਨਰੀ ਸਮੱਗਰੀ ਵੱਡੇ ਪੱਧਰ 'ਤੇ ਉਤਪਾਦਨ ਲਈ ਢੁਕਵੀਂ ਹੈ, ਨਵੀਂ ਉਤਪਾਦਨ ਸਮਰੱਥਾ ਸੀਮਤ ਰਹਿੰਦੀ ਹੈ। ਲਾਗਤ ਦੇ ਦਬਾਅ ਅਤੇ ਉਦਯੋਗ ਦੇ ਇਕਜੁੱਟ ਹੋਣ ਕਾਰਨ ਮੌਜੂਦਾ ਕੰਪਨੀਆਂ ਦੀਆਂ ਕੀਮਤਾਂ ਘੱਟ ਹਨ। ਬਾਜ਼ਾਰ ਵਿੱਚ ਸਸਤੇ ਨਵੇਂ ਊਰਜਾ ਵਾਹਨਾਂ ਦੇ ਹੜ੍ਹ ਦੇ ਨਾਲ, ਟਰਨਰੀ ਲਿਥੀਅਮ ਬੈਟਰੀਆਂ ਮੁਨਾਫ਼ਾ ਕਮਾਉਣ ਲਈ ਸੰਘਰਸ਼ ਕਰ ਰਹੀਆਂ ਹਨ।

ਲਿਥੀਅਮ ਆਇਰਨ ਫਾਸਫੇਟ

LFP ਵਰਤਮਾਨ ਵਿੱਚ ਮਜ਼ਬੂਤ ਮੰਗ ਅਤੇ ਸਪਲਾਈ ਦਾ ਆਨੰਦ ਮਾਣਦਾ ਹੈ, ਜੋ ਕਿ ਟਰਨਰੀ ਸਮੱਗਰੀਆਂ ਤੋਂ ਵੱਧ ਪ੍ਰਦਰਸ਼ਨ ਕਰ ਰਿਹਾ ਹੈ। ਹੀਟ ਪੰਪ ਏਅਰ ਕੰਡੀਸ਼ਨਰਾਂ ਦੀ ਸ਼ੁਰੂਆਤ ਨੇ LFP ਬੈਟਰੀਆਂ ਦੇ ਘੱਟ-ਤਾਪਮਾਨ ਪ੍ਰਦਰਸ਼ਨ ਵਿੱਚ ਸੁਧਾਰ ਕੀਤਾ ਹੈ। ਬੈਟਰੀ ਤਕਨਾਲੋਜੀ ਅਤੇ ਥਰਮਲ ਪ੍ਰਬੰਧਨ ਪ੍ਰਣਾਲੀਆਂ ਵਿੱਚ ਤਰੱਕੀ ਨੇ ਇਲੈਕਟ੍ਰਿਕ ਵਾਹਨਾਂ ਵਿੱਚ LFP ਨੂੰ ਅਪਣਾਉਣ ਵਿੱਚ ਹੋਰ ਵਾਧਾ ਕੀਤਾ ਹੈ, ਘੱਟ-ਤਾਪਮਾਨ ਦੀ ਟਿਕਾਊਤਾ ਨੂੰ ਵਧਾਇਆ ਹੈ ਅਤੇ ਹੋਰ ਮਾਡਲਾਂ ਵਿੱਚ ਇਸਦੀ ਵਰਤੋਂ ਦਾ ਵਿਸਤਾਰ ਕੀਤਾ ਹੈ।

2024 ਦੀਆਂ ਪਹਿਲੀਆਂ ਤਿੰਨ ਤਿਮਾਹੀਆਂ ਵਿੱਚ, ਲਿਥੀਅਮ ਦੀਆਂ ਵਧਦੀਆਂ ਕੀਮਤਾਂ ਨੇ LFP ਉਦਯੋਗ ਨੂੰ ਸਸਤੀ ਵਸਤੂ ਸੂਚੀ ਨਾਲ ਦੁਬਾਰਾ ਸਟਾਕ ਕਰਨ ਲਈ ਮਜਬੂਰ ਕੀਤਾ। ਜਿਵੇਂ ਕਿ ਲਿਥੀਅਮ ਬੈਟਰੀ ਉਦਯੋਗ ਵਿੱਚ ਉਤਪਾਦਨ ਸਮਾਂ-ਸਾਰਣੀ ਅਤੇ ਸੰਚਾਲਨ ਦਰਾਂ ਹੌਲੀ-ਹੌਲੀ ਠੀਕ ਹੋ ਗਈਆਂ, LFP ਉਤਪਾਦਨ ਅਤੇ ਸਮਰੱਥਾ ਪਿਛਲੇ ਸਾਲ ਦੇ ਮੁਕਾਬਲੇ ਕਾਫ਼ੀ ਵਧ ਗਈ। ਹਾਲਾਂਕਿ, 2024 ਦੀਆਂ ਪਹਿਲੀਆਂ ਤਿੰਨ ਤਿਮਾਹੀਆਂ ਵਿੱਚ, LFP ਬੈਟਰੀ ਉਤਪਾਦਨ ਨੇ ਸਥਾਪਤ ਸਮਰੱਥਾ ਨੂੰ ਦੁੱਗਣਾ ਕਰ ਦਿੱਤਾ, ਜੋ ਕਿ ਸਮੁੱਚੀ ਮਾਰਕੀਟ ਮੰਗ ਨੂੰ ਪਾਰ ਕਰ ਗਿਆ। ਸਪਲਾਈ ਅਤੇ ਮੰਗ ਵਿਚਕਾਰ ਇਸ ਅਸਥਾਈ ਬੇਮੇਲ ਨੇ ਉਦਯੋਗ ਨੂੰ ਵਸਤੂ ਸੂਚੀ ਵਿਵਸਥਾਵਾਂ ਵਿੱਚ ਡੂੰਘਾਈ ਨਾਲ ਉਲਝਾ ਦਿੱਤਾ ਹੈ, ਲਾਗਤਾਂ ਨੂੰ ਘਟਾਉਣ ਲਈ ਗੰਭੀਰ ਦਬਾਅ ਦਾ ਸਾਹਮਣਾ ਕਰਨਾ ਪੈ ਰਿਹਾ ਹੈ।

2024 ਵਿੱਚ, LFP ਉਤਪਾਦਨ ਸਮਰੱਥਾ 5.2 ਮਿਲੀਅਨ ਟਨ ਤੱਕ ਪਹੁੰਚ ਗਈ, ਜਦੋਂ ਕਿ ਅਸਲ ਉਤਪਾਦਨ ਸਿਰਫ 2.4 ਮਿਲੀਅਨ ਟਨ ਸੀ, ਜਿਸਦੇ ਨਤੀਜੇ ਵਜੋਂ ਸਮਰੱਥਾ ਉਪਯੋਗਤਾ ਦਰ 50% ਤੋਂ ਘੱਟ ਸੀ।

LFP ਲਿਥੀਅਮ ਬੈਟਰੀ ਉਦਯੋਗ ਦਾ ਇੱਕ ਬਹੁਤ ਹੀ ਗੁੰਝਲਦਾਰ ਹਿੱਸਾ ਬਣ ਗਿਆ ਹੈ। ਜ਼ਿਆਦਾ ਸਮਰੱਥਾ ਨੇ ਉਤਪਾਦਾਂ ਦੀਆਂ ਕੀਮਤਾਂ ਅਤੇ ਕਾਰਪੋਰੇਟ ਮੁਨਾਫ਼ਿਆਂ 'ਤੇ ਇੱਕ ਲੰਮਾ ਪਰਛਾਵਾਂ ਪਾਇਆ ਹੈ।

LFP ਸਮੱਗਰੀ ਵਿੱਚ ਹਾਲੀਆ ਵਿਕਾਸ

ਆਪਣੀ ਪ੍ਰਸਿੱਧੀ ਦੇ ਬਾਵਜੂਦ, LFP ਉਦਯੋਗ ਚੁਣੌਤੀਆਂ ਦਾ ਸਾਹਮਣਾ ਕਰ ਰਿਹਾ ਹੈ। ਕੁਝ ਉੱਚ-ਅੰਤ ਵਾਲੇ LFP ਉਤਪਾਦਾਂ ਦੀ ਸਪਲਾਈ ਇਸ ਸਮੇਂ ਘੱਟ ਹੈ, ਜਿਸ ਕਾਰਨ ਕੁਝ ਕੰਪਨੀਆਂ ਲਈ ਲਗਭਗ ਪੂਰਾ ਉਤਪਾਦਨ ਅਤੇ ਕੀਮਤਾਂ ਵਿੱਚ ਵਾਧਾ ਹੋ ਰਿਹਾ ਹੈ। ਇਹ ਮੁੱਖ ਤੌਰ 'ਤੇ ਉਤਪਾਦ ਸੰਕੁਚਿਤਤਾ ਅਤੇ ਪ੍ਰਕਿਰਿਆ ਅੱਪਗ੍ਰੇਡਾਂ ਦੀ ਵਧਦੀ ਮੰਗ ਦੇ ਕਾਰਨ ਹੈ, ਜਿਸ ਨੇ ਇੱਕ ਨਕਲੀ ਕੀਮਤ ਵਾਧੇ ਨੂੰ ਸ਼ੁਰੂ ਕੀਤਾ ਹੈ।

LFP ਸਮੱਗਰੀ ਨੂੰ ਦੋ ਵਾਰ ਸਿੰਟਰ ਕੀਤਾ ਜਾ ਸਕਦਾ ਹੈ। ਊਰਜਾ ਘਣਤਾ ਵਧਾਉਣ ਲਈ, ਨਿਰਮਾਤਾ ਸਿੰਗਲ ਸਿੰਟਰਿੰਗ ਤੋਂ ਡਬਲ ਸਿੰਟਰਿੰਗ ਵਿੱਚ ਅਪਗ੍ਰੇਡ ਕਰ ਰਹੇ ਹਨ, ਜੋ ਸਮੱਗਰੀ ਸੰਕੁਚਿਤ ਘਣਤਾ ਨੂੰ ਵਧਾਉਂਦਾ ਹੈ। ਹਾਲਾਂਕਿ, ਇਹ ਲਾਗਤਾਂ ਅਤੇ ਲਾਈਨ ਵਰਤੋਂ ਨੂੰ ਮਹੱਤਵਪੂਰਨ ਤੌਰ 'ਤੇ ਵਧਾਉਂਦਾ ਹੈ। ਮੂਲ ਰੂਪ ਵਿੱਚ, ਉਤਪਾਦਨ ਸਮਰੱਥਾ ਅੱਧੀ ਘਟਾ ਦਿੱਤੀ ਗਈ ਸੀ, ਪਰ ਡਬਲ ਸਿੰਟਰਿੰਗ ਪ੍ਰਤੀ ਟਨ ਸਮੱਗਰੀ ਲਈ 2,000 RMB ਦੀ ਵਾਧੂ ਲਾਗਤ ਜੋੜਦੀ ਹੈ। ਨਤੀਜੇ ਵਜੋਂ, LFP ਸਮੱਗਰੀ ਦੀਆਂ ਕੀਮਤਾਂ ਵਿੱਚ 1,000-2,000 RMB ਦਾ ਵਾਧਾ ਹੋਇਆ ਜਾਪਦਾ ਹੈ, ਹਾਲਾਂਕਿ ਇਹ ਵਾਧਾ ਡਬਲ ਸਿੰਟਰਿੰਗ ਦੀਆਂ ਉੱਚ ਲਾਗਤਾਂ ਨੂੰ ਪੂਰਾ ਕਰਨ ਵਿੱਚ ਅਸਫਲ ਰਹਿੰਦਾ ਹੈ।

ਜਦੋਂ ਕਿ ਉਦਯੋਗ ਠੀਕ ਹੋ ਰਿਹਾ ਹੈ ਅਤੇ ਉਤਪਾਦਾਂ ਦੀਆਂ ਕੀਮਤਾਂ ਵੱਧ ਰਹੀਆਂ ਜਾਪਦੀਆਂ ਹਨ, ਨਵੇਂ ਤਕਨੀਕੀ ਅਪਗ੍ਰੇਡ ਅਤੇ ਕੀਮਤਾਂ ਵਿੱਚ ਕਟੌਤੀ ਚੁੱਪ-ਚਾਪ ਚੱਲ ਰਹੀ ਹੈ। ਇਹ ਰੁਝਾਨ ਸੰਭਾਵਤ ਤੌਰ 'ਤੇ 2025 ਵਿੱਚ ਲੈਂਡਸਕੇਪ ਨੂੰ ਆਕਾਰ ਦੇਵੇਗਾ। ਵੱਡੀਆਂ ਕੰਪਨੀਆਂ ਨੂੰ ਦੁਬਿਧਾਵਾਂ ਦਾ ਸਾਹਮਣਾ ਕਰਨਾ ਪੈ ਸਕਦਾ ਹੈ, ਮੁਨਾਫਾ ਕਮਾਉਣ ਲਈ ਸੰਘਰਸ਼ ਕਰਦੇ ਹੋਏ ਵਧੇਰੇ ਨਿਵੇਸ਼ ਕਰਨ, ਉਤਪਾਦਨ ਵਧਾਉਣ ਅਤੇ ਉਤਪਾਦਾਂ ਨੂੰ ਅਪਗ੍ਰੇਡ ਕਰਨ ਦੀ ਜ਼ਰੂਰਤ ਹੋ ਸਕਦੀ ਹੈ। ਖਾਤਮੇ ਦੀ ਖੇਡ ਤੇਜ਼ ਹੋ ਰਹੀ ਹੈ।

ਦੋ ਹੱਦਾਂ: ਉੱਚ-ਅੰਤ ਦੀ ਕਾਰਗੁਜ਼ਾਰੀ ਬਨਾਮ ਘੱਟ-ਅੰਤ ਦੀ ਲਾਗਤ ਕੁਸ਼ਲਤਾ

ਲਿਥੀਅਮ ਬੈਟਰੀ ਕੈਥੋਡ ਮਟੀਰੀਅਲ ਇੰਡਸਟਰੀ ਇੱਕ ਚੌਰਾਹੇ 'ਤੇ ਖੜ੍ਹੀ ਹੈ। ਜਦੋਂ ਕਿ ਟਰਨਰੀ ਮਟੀਰੀਅਲ ਉੱਚ ਪ੍ਰਦਰਸ਼ਨ ਦੀ ਪੇਸ਼ਕਸ਼ ਕਰਦੇ ਹਨ, ਉਨ੍ਹਾਂ ਦੀਆਂ ਲਾਗਤਾਂ ਉੱਚੀਆਂ ਰਹਿੰਦੀਆਂ ਹਨ। ਨਤੀਜੇ ਵਜੋਂ, ਡਿਵੈਲਪਰ ਦੋ ਹੱਦਾਂ ਦਾ ਪਿੱਛਾ ਕਰ ਰਹੇ ਹਨ: "ਉੱਚ-ਅੰਤ, ਉੱਚ-ਪ੍ਰਦਰਸ਼ਨ" ਅਤੇ "ਘੱਟ-ਅੰਤ, ਲਾਗਤ-ਪ੍ਰਭਾਵਸ਼ਾਲੀ" ਸਮੱਗਰੀ।

ਇੱਕ ਦਿਸ਼ਾ ਉੱਚ-ਪ੍ਰਦਰਸ਼ਨ ਵਾਲੇ ਉਤਪਾਦਾਂ 'ਤੇ ਕੇਂਦ੍ਰਿਤ ਹੈ, ਜਿਵੇਂ ਕਿ ਉੱਚ-ਨਿਕਲ ਅਰਧ-ਸੌਲਿਡ ਬੈਟਰੀਆਂ, ਪੂਰੀ-ਤਾਰ ਵੱਡੀਆਂ ਸਿਲੰਡਰ ਵਾਲੀਆਂ ਬੈਟਰੀਆਂ, ਉੱਨਤ ਔਜ਼ਾਰ, ਇਲੈਕਟ੍ਰਿਕ ਸੁਪਰਕਾਰਾਂ, ਅਤੇ ਉੱਡਣ ਵਾਲੀਆਂ ਕਾਰਾਂ।

ਦੂਜੀ ਦਿਸ਼ਾ ਲਾਗਤ ਕੁਸ਼ਲਤਾ, ਲਿਥੀਅਮ ਆਇਰਨ ਮੈਂਗਨੀਜ਼ ਫਾਸਫੇਟ ਸਮੱਗਰੀ ਵਿਕਸਤ ਕਰਨ ਅਤੇ ਮੈਂਗਨੀਜ਼ ਦੇ ਆਧਾਰ 'ਤੇ ਨਵੀਆਂ ਸਰਹੱਦਾਂ ਦੀ ਪੜਚੋਲ ਕਰਨ 'ਤੇ ਜ਼ੋਰ ਦਿੰਦੀ ਹੈ। ਇੱਕ ਵਾਰ ਵੱਡੇ ਪੱਧਰ 'ਤੇ ਪੈਦਾ ਹੋਣ ਤੋਂ ਬਾਅਦ, ਲਿਥੀਅਮ ਆਇਰਨ ਮੈਂਗਨੀਜ਼ ਫਾਸਫੇਟ ਦੇ EV ਬੈਟਰੀਆਂ ਲਈ ਆਦਰਸ਼ ਵਿਕਲਪ ਬਣਨ ਦੀ ਉਮੀਦ ਹੈ, ਜਿਸ ਵਿੱਚ ਟਰਨਰੀ ਅਤੇ LFP ਬੈਟਰੀਆਂ ਦੇ ਫਾਇਦਿਆਂ ਨੂੰ ਘੱਟੋ-ਘੱਟ ਕਮੀਆਂ ਨਾਲ ਜੋੜਿਆ ਗਿਆ ਹੈ।

LFP ਲਈ, ਨਿਰਮਾਣ ਅਤੇ ਲਾਗਤ ਕੁਸ਼ਲਤਾ ਦੋਵਾਂ ਵਿੱਚ ਸੁਧਾਰ ਦੀ ਲੋੜ ਹੈ। ਸਮੱਗਰੀ-ਪੱਧਰ ਦੇ ਅਨੁਕੂਲਨ ਦੀਆਂ ਸੀਮਾਵਾਂ ਦੇ ਨੇੜੇ ਆਉਣ ਦੇ ਨਾਲ, ਫੋਕਸ ਪ੍ਰਕਿਰਿਆ ਅਨੁਕੂਲਨ ਵੱਲ ਤਬਦੀਲ ਹੋ ਗਿਆ ਹੈ। ਕੰਪਨੀਆਂ ਹੁਣ ਸਮੱਗਰੀ ਦੀ ਵਰਤੋਂ ਨੂੰ ਬਿਹਤਰ ਬਣਾਉਣ ਲਈ ਡਬਲ ਸਿੰਟਰਿੰਗ ਦੀ ਵਰਤੋਂ ਕਰਦੇ ਹੋਏ, ਉਪਕਰਣਾਂ ਅਤੇ ਪ੍ਰਕਿਰਿਆਵਾਂ ਨੂੰ ਅਨੁਕੂਲ ਬਣਾਉਣ ਦਾ ਟੀਚਾ ਰੱਖ ਰਹੀਆਂ ਹਨ। ਇੱਕ ਹੋਰ ਪਹੁੰਚ ਵਿੱਚ ਊਰਜਾ ਦੀ ਖਪਤ ਅਤੇ ਨਿਕਾਸ ਨੂੰ ਘਟਾਉਣ ਲਈ ਲਿਥੀਅਮ ਕਾਰਬੋਨੇਟ ਨੂੰ ਲਿਥੀਅਮ ਡਾਈਹਾਈਡ੍ਰੋਜਨ ਫਾਸਫੇਟ ਨਾਲ ਬਦਲਣਾ ਸ਼ਾਮਲ ਹੈ।

2025 ਵਿੱਚ ਲਿਥੀਅਮ ਬੈਟਰੀ ਕੈਥੋਡ ਸਮੱਗਰੀ ਲਈ ਮਾਰਕੀਟ ਆਉਟਲੁੱਕ

ਹਾਲੀਆ ਸਰਵੇਖਣ ਅਗਲੇ ਸਾਲ ਕੀਮਤਾਂ ਵਿੱਚ ਵਾਧੇ ਦੀ ਮਜ਼ਬੂਤ ਮੰਗ ਨੂੰ ਦਰਸਾਉਂਦੇ ਹਨ। ਕੈਥੋਡ ਮਟੀਰੀਅਲ ਪਲਾਂਟ ਪ੍ਰਤੀ ਟਨ ਲਗਭਗ 3,000 RMB ਵਾਧੇ ਦੀ ਮੰਗ ਕਰ ਰਹੇ ਹਨ, ਜਦੋਂ ਕਿ ਬੈਟਰੀ ਪਲਾਂਟ ਇਸ ਵਿੱਚੋਂ ਸਿਰਫ਼ ਅੱਧਾ - ਲਗਭਗ 1,500 RMB ਪ੍ਰਤੀ ਟਨ - ਸਵੀਕਾਰ ਕਰਨ ਦੀ ਸੰਭਾਵਨਾ ਰੱਖਦੇ ਹਨ।

ਸ਼ੁਰੂਆਤੀ ਨਤੀਜੇ ਦਰਸਾਉਂਦੇ ਹਨ ਕਿ ਲਿਥੀਅਮ ਕਾਰਬੋਨੇਟ ਪਲਾਂਟਾਂ ਨੇ ਅਗਲੇ ਸਾਲ ਲਈ ਲੰਬੇ ਸਮੇਂ ਦੀਆਂ ਛੋਟਾਂ ਘਟਾ ਦਿੱਤੀਆਂ ਹਨ ਜਾਂ ਬੰਦ ਕਰ ਦਿੱਤੀਆਂ ਹਨ। ਇਸ ਦੌਰਾਨ, LFP ਕੱਚੇ ਮਾਲ ਦੀਆਂ ਕੀਮਤਾਂ ਵਧ ਰਹੀਆਂ ਹਨ, ਅਤੇ ਫਾਸਫੇਟ ਪਲਾਂਟ ਸਪੱਸ਼ਟ ਤੌਰ 'ਤੇ ਕੀਮਤਾਂ ਵਿੱਚ ਵਾਧੇ ਦਾ ਸਮਰਥਨ ਕਰ ਰਹੇ ਹਨ। ਇਹ ਸੁਝਾਅ ਦਿੰਦਾ ਹੈ ਕਿ LFP ਕੈਥੋਡ ਸਮੱਗਰੀ ਦੀਆਂ ਕੀਮਤਾਂ ਵਧਣ ਲਈ ਤਿਆਰ ਹਨ, ਮੁੱਖ ਸਵਾਲ ਵਾਧੇ ਦੀ ਅੰਤਮ ਹੱਦ ਹੈ।

ਵਿਸਤ੍ਰਿਤ ਵਿਸ਼ਲੇਸ਼ਣ ਤੋਂ ਪਤਾ ਚੱਲਦਾ ਹੈ ਕਿ 2.45 ਅਤੇ 2.50 ਦੀ ਸੰਕੁਚਿਤ ਘਣਤਾ ਵਾਲੇ ਉਤਪਾਦ ਮਾਰਕੀਟ ਹਿੱਸੇਦਾਰੀ 'ਤੇ ਹਾਵੀ ਹੁੰਦੇ ਹਨ। ਉਨ੍ਹਾਂ ਦੀ ਇਕਸਾਰਤਾ ਅਤੇ ਘੱਟ ਤਕਨੀਕੀ ਰੁਕਾਵਟਾਂ ਘਾਟੇ ਦੇ ਰੁਝਾਨ ਨੂੰ ਉਲਟਾਉਣਾ ਮੁਸ਼ਕਲ ਬਣਾਉਂਦੀਆਂ ਹਨ।

ਹਾਲਾਂਕਿ, ਉੱਚ ਸੰਕੁਚਨ ਘਣਤਾ (2.55 ਤੋਂ ਉੱਪਰ) ਵਾਲੇ ਉਤਪਾਦਾਂ ਦਾ ਬਾਜ਼ਾਰ ਵਿੱਚ ਹਿੱਸਾ ਘੱਟ ਹੁੰਦਾ ਹੈ। ਉਨ੍ਹਾਂ ਦੀਆਂ ਉੱਚ ਤਕਨੀਕੀ ਰੁਕਾਵਟਾਂ ਅਤੇ ਉੱਤਮ ਊਰਜਾ ਘਣਤਾ ਮੰਗ ਵਾਧੇ ਨੂੰ ਅੱਗੇ ਵਧਾਉਣਗੇ। ਉੱਚ-ਸੰਕੁਚਨ ਕੈਥੋਡ ਸਮੱਗਰੀ ਤਿਆਰ ਕਰਨ ਵਾਲੇ ਨਿਰਮਾਤਾ ਗੱਲਬਾਤ ਕਰਨ ਦੀ ਸ਼ਕਤੀ ਪ੍ਰਾਪਤ ਕਰਨਗੇ ਅਤੇ 2025 ਦੇ ਦੂਜੇ ਅੱਧ ਵਿੱਚ ਨੁਕਸਾਨ ਨੂੰ ਮੁਨਾਫ਼ੇ ਵਿੱਚ ਬਦਲਣ ਦੀ ਸੰਭਾਵਨਾ ਹੈ।

2025 ਵਿੱਚ LFP ਮਾਰਕੀਟ ਦੇ ਸਥਿਰ ਹੋਣ ਅਤੇ ਵਧਣ ਦੀ ਉਮੀਦ ਹੈ। ਹਾਲਾਂਕਿ, ਬਸੰਤ ਤਿਉਹਾਰ ਦੀਆਂ ਛੁੱਟੀਆਂ ਅਤੇ 2024 ਤੋਂ ਉੱਚ ਵਸਤੂ ਪੱਧਰ 2025 ਦੇ ਸ਼ੁਰੂ ਵਿੱਚ ਸਪਲਾਈ ਅਤੇ ਮੰਗ ਨੂੰ ਕਮਜ਼ੋਰ ਕਰ ਸਕਦੇ ਹਨ। ਸਾਲ ਦੇ ਦੂਜੇ ਅੱਧ ਵਿੱਚ ਮਜ਼ਬੂਤ ਪ੍ਰਦਰਸ਼ਨ ਦਿਖਾਉਣ ਦੀ ਉਮੀਦ ਹੈ।

ਐਪਿਕ ਪਾਊਡਰ

ਐਪਿਕ ਪਾਊਡਰ'ਸ ਹਵਾਈ ਜੈੱਟ ਮਿੱਲ ਅਤਿ-ਸ਼ੁਧਤਾ ਵਾਲੀ ਸੰਕੁਚਿਤ ਹਵਾ ਦੀ ਵਰਤੋਂ ਕਰਕੇ ਅਤਿ-ਬਰੀਕ ਪਾਊਡਰ ਤਿਆਰ ਕੀਤੇ ਜਾਂਦੇ ਹਨ। ਸਾਡੀ ਉੱਨਤ ਵਰਗੀਕਰਨ ਤਕਨਾਲੋਜੀ 3-45 ਮਾਈਕਰੋਨ ਦੇ D97 ਨਾਲ ਸਖ਼ਤ ਕਾਰਬਨ ਪੈਦਾ ਕਰਦੇ ਹੋਏ, ਸਟੀਕ ਕਣ ਆਕਾਰ ਨਿਯੰਤਰਣ ਨੂੰ ਯਕੀਨੀ ਬਣਾਉਂਦੀ ਹੈ। ਇਹ ਉੱਚ-ਪ੍ਰਦਰਸ਼ਨ ਵਾਲੀ ਲਿਥੀਅਮ ਬੈਟਰੀ ਕੈਥੋਡ ਸਮੱਗਰੀ ਲਈ ਆਦਰਸ਼ ਹੈ, ਜਿੱਥੇ ਸਮਰੱਥਾ ਅਤੇ ਚੱਕਰ ਜੀਵਨ ਲਈ ਇਕਸਾਰ ਕਣ ਆਕਾਰ ਮਹੱਤਵਪੂਰਨ ਹੁੰਦਾ ਹੈ।